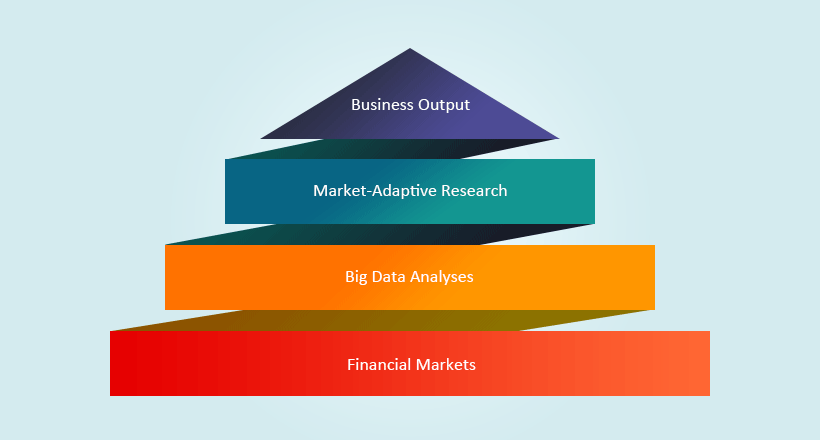

In the context of an ever-changing economy and financial markets, we provide quality solutions. Our deep interest in economic dynamics and the behavior of market participants allows us to explore their effects on asset prices.

We are able to make multifaceted assessments due to our knowledge of cutting-edge information and big data technologies. The following three factors are important in our assessments:

- Significant events

- The increasing complexity of economic networks

- Investor behavior

As examples of our focus, we have conducted 1) topic and tone analyses using information provided by central banks or corporate management (e.g. texts, images), 2) corporate valuations through unique economic network data, and 3) investor behavior analyses based on high frequency and money flow data.

We provide quality and timely investment models. These models incorporate recently available big data sources, the latest investment theories and technologies, and asset management knowledge acquired over many years.

Primary scope and activities

Active Investment Strategy

- Japanese and global equity strategies

- Currency and fixed-income strategies

Index Strategy

- Portfolio risk management

- Smart beta strategies

Multi-Asset Strategy

- Downside protection strategies