We conduct rigorous research on various risks and issues common to financial institutions. Our research is based on the latest theories, and promotes the development and sophistication of practical models.

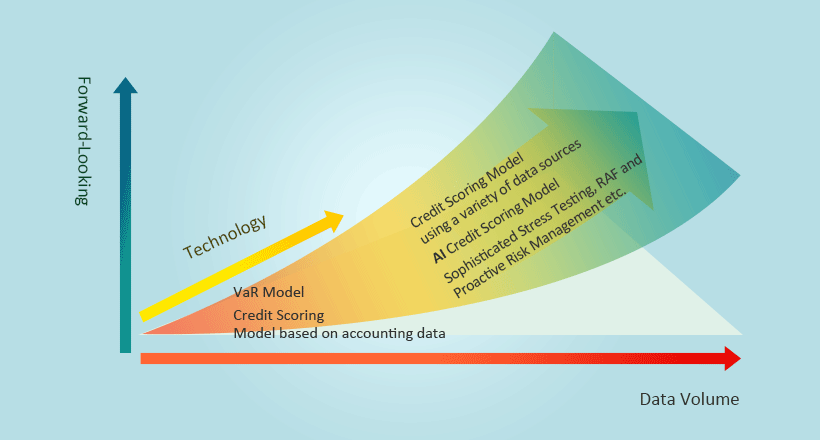

Financial institutions are exposed to a wide variety of risks such as market, credit, operational, liquidity, and systemic risks. Therefore, for the purpose of maintaining financial institutions as part of the social infrastructure, various financial regulations have been established. Ever since the financial crisis of 2007-2008, such regulations have become more complex and stringent. Additionally, we are introducing stress testing by simulating risk scenarios never before experienced and risk appetite frameworks (RAF) that promote the sound management of financial institutions with a good balance between risk and returns. Efforts in proactive risk management that enable the swift detection of changing circumstances have been rapidly advancing with the development of technologies and the rapid expansion of relevant data. The pace of sophistication is accelerating.

We are actively combining the most advanced analytical technologies such as artificial intelligence (AI) and text mining with our deep knowledge and extensive experience in risk management to provide solutions that exceed customer expectations.

Primary scope and activities

Management of risks emergent of financial markets and transactions

- Integrated risks: Combined risks based on their correlations

- Integration of market and credit risks

- Credit risks: Credit risks related to transaction counterparties and products

- Credit ratings / counterparties / credit products

- Market risks: Risks emergent of products exchanged in financial markets

- Derivatives

- Liquidity risks: Risks in which the procurement of funds or sales/purchases of a product are made under circumstances that may be less favorable than expected

- Market liquidity / fund liquidity

Management of risks emergent of human behavior

- Operational risks: Risks emergent of the actions of executives, employees, IT systems, and exogenous events

- Reputational risks: Risks emergent of groundless defamation and the spreading of rumors

- Prepayment risks: Risks of opportunity loss due to contracts ending prematurely

- Housing loans / fixed deposits

Management of risks emergent of models or methods

- Model risks: Risks in which the model being used does not account for actual relevant events

Stress tests

Management of risks against potential future events by applying a strong stimulus to data and model parameters, or forward-looking scenarios (i.e. black swan events) on risk management models